The COVID pandemic has hit many commercial sectors hard. The impact on the hospitality, non-essential retail and travel industries in particular has grabbed a lot of the headlines. But what about the leisure sector?

There is little doubt that venues and destinations that rely on ticket sales have been severely disrupted, and perhaps even changed forever, by the pandemic. But in business you can only look forward. With 2021 arriving, we wanted to understand exactly what the prospects for ticket-selling operations look like in the year ahead and beyond.

We wanted to unpick exactly what the COVID impact has been on these businesses and analyse which changes are likely to be short term and which more permanent. Our goal was to use this insight to put together a vision for what 2021 looks like for the ticketing and leisure sectors, and therefore provide strategic guidance to help businesses prepare and secure their revenues.

As part of this project, we spoke with more than one hundred managers and conducted more than 20 COVID impact analyses on businesses including amusement parks, opera houses, theaters, museums, ski resort mountain railways and more. Here is what we found.

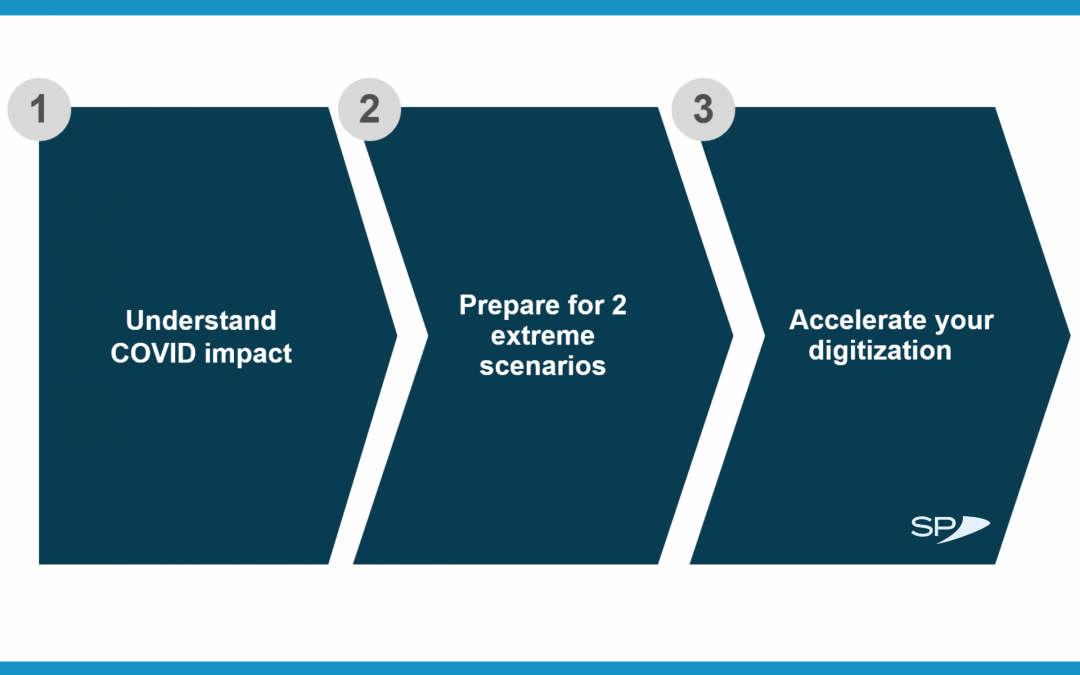

Three key impacts

From our data, we identified three key ways in which COVID has affected leisure organisations that rely on ticket sales:

In terms of how COVID has changed visitor behaviour, we have seen obvious short-term effects such as a significant decline in guest numbers and sales caused by lockdown measures and social distancing restrictions. But we also believe there are three longer term changes that will last at least through 2021 and quite likely beyond:

- More localization: People are more reluctant to travel long distances in the wake of coronavirus, especially abroad. Many airlines don’t expect intercontinental traffic to rebound until 2023/4, so for the mid-term visitors to attractions are much more likely to be local.

- More spontaneous bookings: Taking the example of ski resort attractions, pre-booking times have decreased by 80 to 90%, even if there are discounts available for booking well in advance. The data showed how reluctant people are to book weeks ahead due to the COVID uncertainty, preferring to leave it to just days or even hours in advance.

- Shorter stays: Similarly, our data shows that people are reluctant to commit to longer stays. With ski resorts again, the average length of stay went down by 30 to 50% and is reduced from four or five days to just two or three days.

As with visitor behaviour, we saw some of the evidence for reduced venue capacity, that was clearly a direct result of social distancing regulations. This is something we can expect (and hope) will ease once the pandemic is under control.

However, we also found evidence that businesses were reducing their capacity voluntarily in response to shifts in customer preferences and attitudes. Put simply, people have become very nervous about being in crowded places, and this psychological wish to avoid large crowds and overfilled places is likely to last much longer than official social distancing rules. If venues don’t want to put customers off, they may have to keep capacity lower to allow more space as a more permanent change.

Finally, digitization is a major trend we have seen in how venues have responded to the pandemic. It can be split into three parts:

- Before the visit: As with many other sectors, the pandemic has seen a significant shift in consumer preference for buying tickets online rather than handing over cash or even paying by card in person. This has triggered investment in web shops, and we’ve seen many smaller mountain railways, museums, opera houses, theaters and other operators that didn’t have web shops before, who are now pushing online sales in big dimensions

- During the visit: We’ve also seen a significant shift to digitization of the experience itself, or the creation of so-called hybrid events. For example, we found that 70-80% of festivals, opera houses, theatres and museums have in some way digitized the content of their shows and exhibitions and then made them available via streaming or by video on demand (VOD). To give a specific example, we spoke with a festival in Norway that used to have twenty five thousand physical visitors that now reaches more than one million people through its online streaming presence.

- After the visit: Thirdly, with all the data that’s gathered through web shops, apps, streaming interaction etc, businesses have a rich resource for nurturing relationships with customers and encouraging return visits with carefully targeted marketing and promotions.

If you want, you can also find the entire content just discussed in a short video in German or in English, or on our Youtube channel.

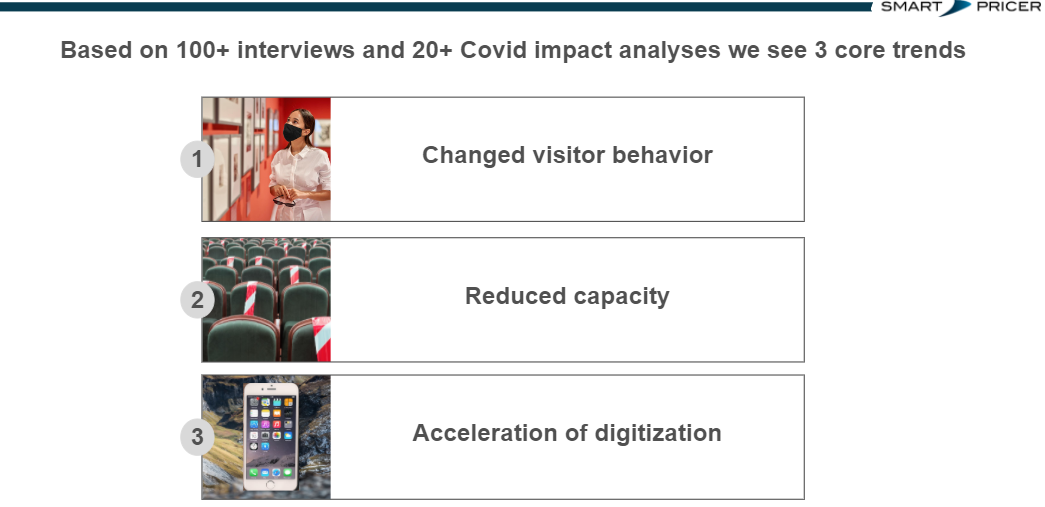

Three step COVID response plan

Taking these insights from the many conversations and in-depth analyses we carried out, our primary objective was to answer this question – what can leisure operators that rely on ticketing do to bolster their recovery and get back on the path of success in 2021?

From the trends we identified above, we have put together the following three step COVID response plan:

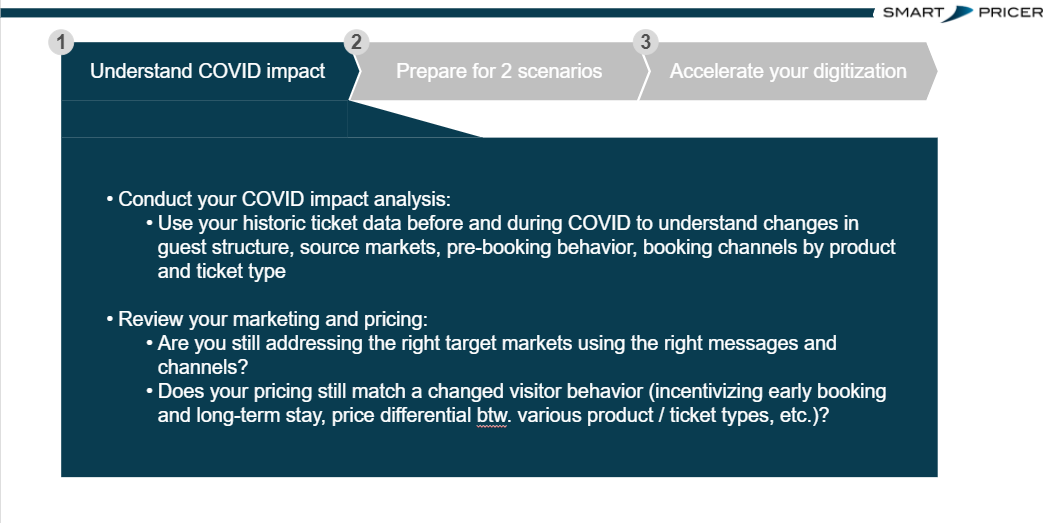

1. Understand COVID impact

The good news is, thanks to the accelerated digitization we have discussed, businesses have a fantastic resource available to understand exactly how COVID has affected them in very fine detail. They can run a comparison of ticket sales data before and during COVID to analyze and understand how their guest structure has changed, how their source markets have changed, how their pre-booking behaviour for various products and product types changed, and how their sales channels have changed.

From this analysis, they should be able to question their marketing and pricing strategy. Are they still targeting the right markets? Are they still sending the right messages? Are they incentivizing the right people to come, and do they still have the right pricing regime for all of the ticket and product types that they have?

2. Prepare for 2 scenarios

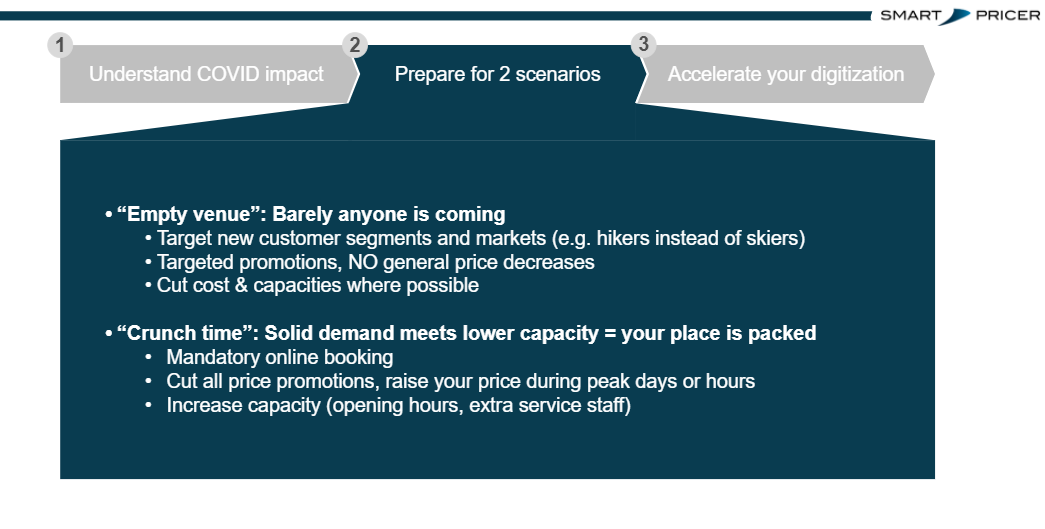

We believe that because of all the uncertainty that still exists around COVID, it is important for venues to plan strategically for two potential outcomes:

- „Empty venue“: What if they find no one is coming, either because they cannot come, or they don’t want to come?

What they can do is re-target their marketing, e.g. we’ve seen mountain railways target not only skiers this winter but also hikers, which is beyond the traditional audience they would try to target. We’ve seen many clients target new markets and new geographies (especially more local markets).

What we wouldn’t recommend is across-the-board price cuts. This risks harming their brand. Targeted promotions for certain customer groups are much more sustainable, and of course they can look at reducing capacity and cutting costs to protect their margins.

- „Crunch time“: On the opposite end of the scale, we discussed above how many operators have voluntarily reduced capacity due to a drop in demand and changed consumer behaviour. What if demand suddenly surges again and they find their venue over-subscribed? We saw exactly this scenario play out with spas and mountain railways when they re-opened last summer, hence reductions in capacity led to overcrowding and huge waiting times.

The best way to mitigate this risk is to make online bookings mandatory. If people have to buy in advance, they can control numbers. Digital booking systems make this easy and as a bonus they also capture more customer data. We’ve also seen the introduction of timeslot ticketing, which helps to operate at or close to capacity at any given time.

If demand is too high, they can also look at pricing. For example, they can cut all promotions back as far as possible, and even consider increasing prices during peak times.

3. Accelerate your digitization

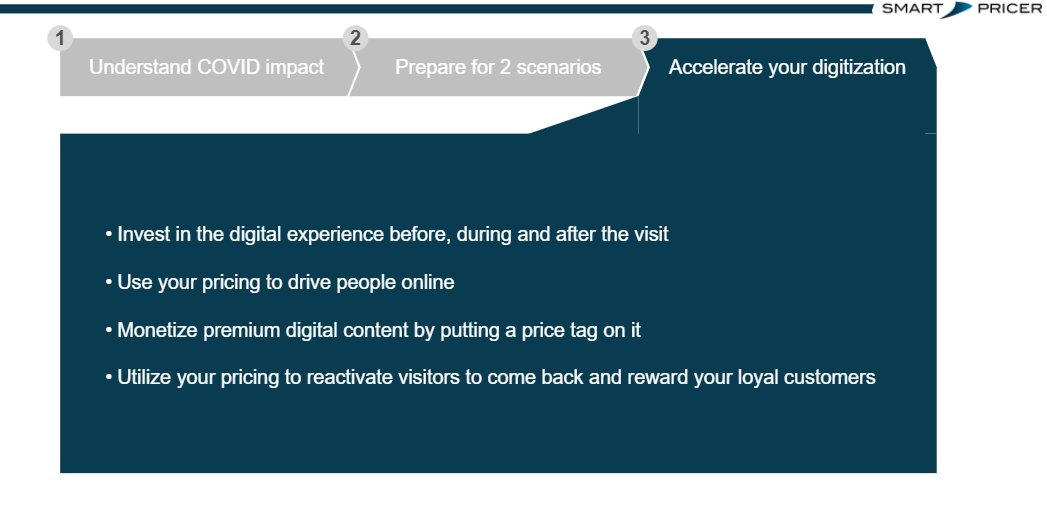

As discussed above, digitization is a significant trend we have seen throughout the pandemic. We believe that leisure venues should continue to invest in accelerating this process as a key part of their response strategy through 2021 and beyond.

Again, it is helpful to segment digitization strategies into before, during and after the visit. For example, ‘before’ can mean investing in the web shop to make the purchasing experience as smooth as possible. It can also mean investing in digital marketing to target new groups and new customer segments, especially local traffic, or the use of pricing to drive more sales online by offering a discount via web shop.

For ‘during’ solutions, we have already mentioned streaming and VOD for events. While this works well as a free service to add value to the customer experience, it can also be monetized. We’ve done a few projects with theatres and opera houses creating premium content where the top productions with the top actors are costing something, and people are willing to pay for it.

Another example of digitization ‘during’ the visit is the use of in-destination apps. These are a great way to add ‘gamification’ to the visitor experience. For example, we’ve seen apps launched at ski resorts which allow visitors to measure the height or top speed they have reached, allowing them to compete with family and friends.

‚After‘ the visit, as we have discussed, they can use all of the data they have gathered to nurture long-term loyalty and repeat visits, to share new experiences, new attractions or new content. They can also use pricing to help reactivate customers – fo example, they can use customer data to run targeted promotions for those customers who they know, if they give them a little offer. By doing so, they are most likely to come back.

Please also find the content of the second part of this blog post in a short video in German or English, or on our YouTube Channel.